Sole Proprietorship Registration

Easily start your own business with a Sole Proprietorship! This simple registration process offers full control, low startup costs, and minimal compliance, making it perfect for solo entrepreneurs.

Package Inclusion : –

- Discussion on business model

- Application submission

- Registration certificate

- GST & MSME Registration, if required

Free Call Back by our Expert

How to Start a Sole Proprietorship Registration

Sole Proprietorship Registration - Overview

A Sole Proprietorship is a type of business that is owned and operated by a single person. It’s one of the simplest business types to set up, making it popular with small business owners and individual entrepreneurs. In this structure, the business and the owner are legally considered the same, which gives the owner full control over the business. However, it also means the owner is personally responsible for all business debts and legal issues.

Key Points About Sole Proprietorship:

- Simple and Affordable Setup: Setting up a sole proprietorship is quick and doesn’t cost much, with minimal paperwork required. This makes it an easy choice for people who want to start their own small business.

- Full Ownership and Control: The owner has total control over every part of the business, from decisions about operations to handling profits. There are no partners or shareholders involved.

- Personal Liability: Since the business and the owner are legally one, the owner is personally responsible for any debts or lawsuits. If the business has financial problems, the owner’s personal assets could be at risk.

- Tax Benefits: All business earnings are reported on the owner’s personal tax return, so there’s no double taxation. This often simplifies the tax process for the owner.

- Limited Funding Options: Unlike larger business structures, a sole proprietorship often relies on the owner’s personal savings or small loans, as it’s not designed to attract large investors.

Basic Registration Steps:

- Choose a Business Name: Select a unique name for your business and check with local authorities to ensure it follows regulations.

- Get Required Licenses and Permits: Depending on your business type, you may need certain permits or licenses from local or state authorities.

- Register for Taxes: You may need a tax identification number for reporting purposes, especially if you plan to hire employees.

- Open a Separate Business Bank Account: Even though it’s not legally required, having a separate bank account helps organize business finances.

Benefits of a Sole Proprietorship

Easy Setup: Starting a sole proprietorship is simple and affordable. There’s minimal paperwork and no complex registration process, which makes it perfect for new entrepreneurs.

Full Control: The owner has complete authority over all business decisions, from finances to daily operations. This means they can manage the business exactly how they want without needing to consult with partners or shareholders.

Tax Advantages: Since the business income is considered personal income, the owner only needs to file a single tax return. This avoids the “double taxation” that other business types sometimes face, where income is taxed at both the business and personal level.

Direct Access to Profits: All business profits go directly to the owner, allowing them to benefit from the success of the business without having to share it.

Privacy: Sole proprietorships often require less public disclosure, meaning the owner can keep certain aspects of the business private, unlike corporations that may have to disclose financial and operational information.

Flexibility: It’s easy to make changes to the business—such as shifting focus, changing product lines, or even closing down—as the owner has full control and isn’t bound by complex structures or agreements.

Minimal Regulations: Sole proprietorships generally face fewer regulatory requirements compared to corporations or partnerships, making it easier to manage compliance and paperwork.

A Sole Proprietorship is one of the simplest and most commonly chosen business structures, especially for small businesses, startups, and individual entrepreneurs. Here are key reasons why one might opt for a Sole Proprietorship:

1. Ease of Setup

- Minimal legal formalities and lower registration costs make it straightforward to start.

- No need to file extensive documentation or adhere to complex compliance requirements.

2. Full Control

- The proprietor has complete control over all decisions, providing flexibility and independence in business operations.

3. Profit Retention

- All profits belong solely to the proprietor without the need to share with partners or investors.

4. Lower Compliance Costs

- Compliance and reporting requirements are minimal compared to other structures like Private Limited Companies or LLPs.

- Tax filing is also simpler, as income is filed as part of the individual’s personal tax returns.

5. Direct Tax Benefits

- Proprietors can claim various deductions and benefits under the Income Tax Act based on their business expenses and income.

6. Simplicity in Operations

- No need to consult partners or stakeholders for decisions, streamlining the business’s day-to-day running.

- Bank accounts and licenses can be secured in the proprietor’s name.

7. Quick Decision Making

- Since the business owner is the sole decision-maker, this structure ensures swift and efficient decision-making.

8. Privacy

- Unlike corporations, which must publish financial results, a sole proprietorship can maintain privacy over its financials.

9. Ideal for Small Businesses

- Suitable for businesses with lower risks, fewer resources, and modest revenue goals.

- Common examples include freelance work, retail stores, and service-oriented businesses.

10. Easier Dissolution

- If the business doesn’t work out, closing a sole proprietorship is easy and involves minimal legal hurdles.

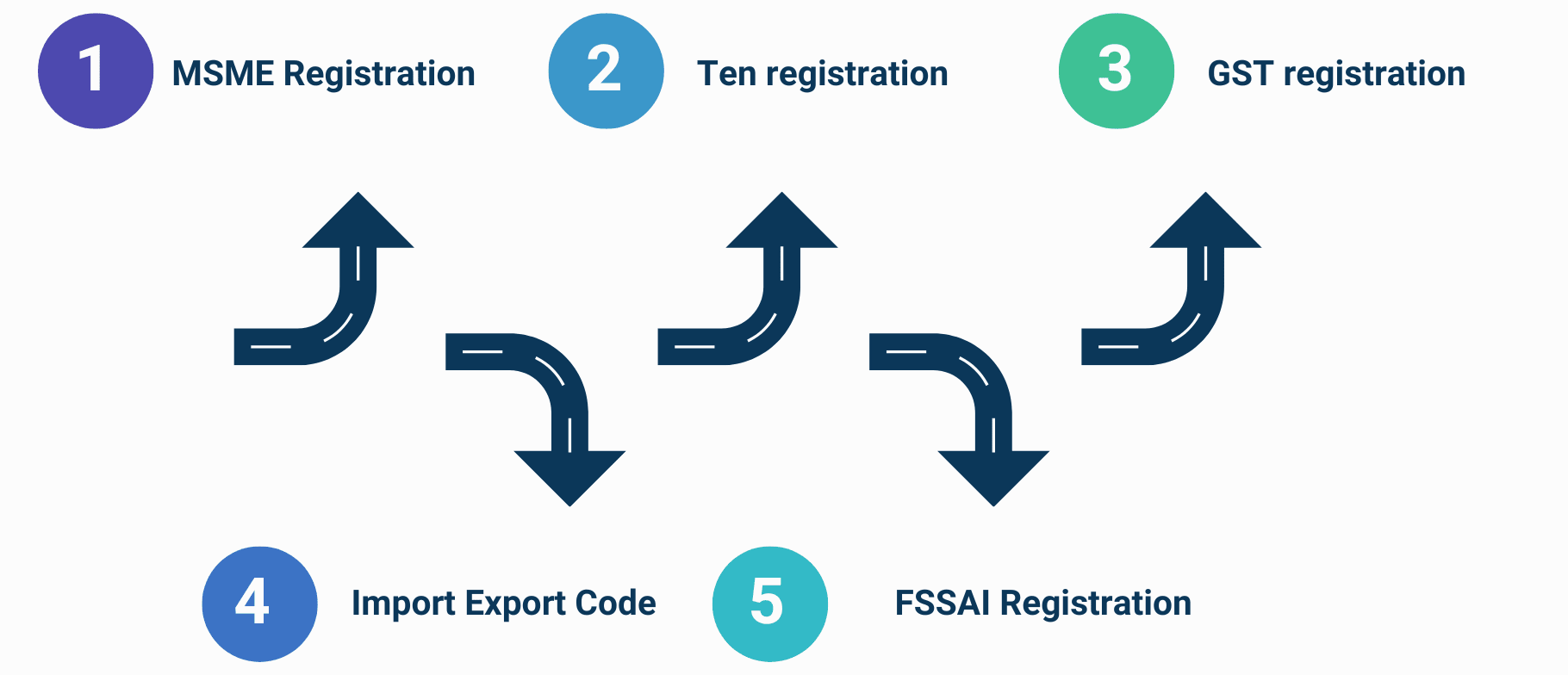

A Sole Proprietorship can be set up by getting a few basic registrations and licenses. Here are some of the main registrations you might need to start a Proprietorship:

1. MSME Registration

- MSME (Micro, Small, and Medium Enterprises) registration, also called Udyog Aadhaar, can be obtained in the name of the business. This registration helps establish that the Sole Proprietorship is recognized under the Ministry of Micro, Small, and Medium Enterprises.

2. TAN Registration

- TAN (Tax Deduction Account Number) is required if the proprietor needs to deduct TDS (Tax Deducted at Source), usually for employee salaries. This number is issued by the Income Tax Department and is only needed if the business plans to deduct TDS on payments.

3. GST Registration

- GST (Goods and Services Tax) registration is necessary if the business sells goods or services exceeding a certain turnover limit. For most services, this limit is an annual turnover above Rs. 20 lakhs, and for goods, it’s Rs. 40 lakhs. This registration is essential for charging GST on sales.

4. Import Export Code (IEC)

- If the Sole Proprietorship deals with importing or exporting goods, it needs an Import Export Code (IEC) from the Director General of Foreign Trade (DGFT). This code is essential for handling international trade.

5. FSSAI Registration

- If the business involves selling or handling food products, it must obtain an FSSAI (Food Safety and Standards Authority of India) license. This license ensures that the business complies with food safety standards.

These registrations help ensure the business complies with legal requirements and operates smoothly.

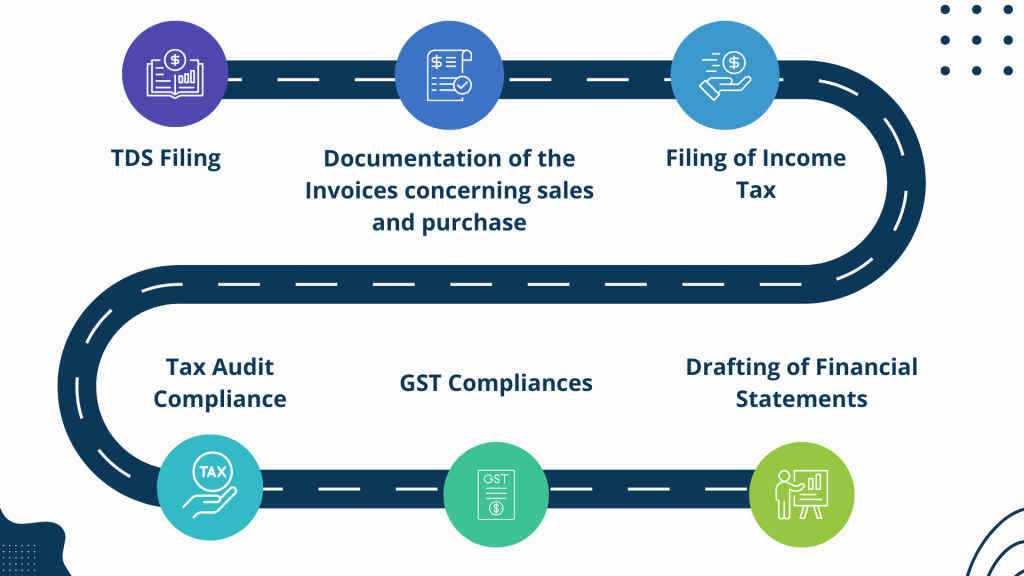

Compliance Checklist for Sole Proprietorship Firm Registration

Compliance Checklist for Sole Proprietorship Firm Registration

The requirements to follow after registering a sole proprietorship are:

- TDS (Tax Deducted at Source) Filing

- Filing of Income Tax Return (ITR)

- GST (Goods and Service Tax) Compliances

- Drafting of Financial Statements

- Tax Audit Compliance

- Documentation of the Invoices concerning sales and purchase

Frequently Asked Questions

A sole proprietorship is a business structure owned and operated by a single person. It’s the simplest and most common form of business, where the owner and the business are legally considered the same entity.

Unlike corporations or partnerships, a sole proprietorship has no separate legal identity from its owner. This means the owner has full control of the business but also assumes all liabilities and debts personally.

Generally, a sole proprietorship doesn’t require formal registration. However, depending on the type and location of your business, you may need a business license, tax registration, or specific permits.

In a sole proprietorship, income from the business is reported on the owner’s personal tax return. The business itself is not taxed separately; instead, profits are subject to personal income tax rates.

Yes, you can hire employees, but you’ll need to register for an Employee Identification Number (EIN) and comply with labor laws regarding wages, benefits, and taxes.

It’s easy and inexpensive to set up, offers complete control to the owner, and has simplified tax filing, as business income and personal income are reported together.

The main risk is unlimited liability, meaning the owner is personally liable for any debts, losses, or legal issues the business encounters. Personal assets may be used to settle business obligations.

Since the business is tied directly to the owner, it cannot be transferred as a separate entity. However, you can sell the business’s assets and transfer its operations to a new owner, who can then start their own business structure.

While not required, having a separate business bank account is strongly recommended for easier financial tracking and tax reporting.

To close, you’ll need to settle any outstanding debts, cancel business licenses, file final tax returns, and notify relevant authorities. The process is simpler than closing other business entities since there are fewer formal requirements.